Investments up to Rs 1.5 lakh can be claimed for deduction under section 80C of the income tax act

The bank fixed deposit (FD) has been the most preferred investment option in India. Investors of all age groups love to park their savings in this investment avenue, given that FDs are safe and returns are certain.

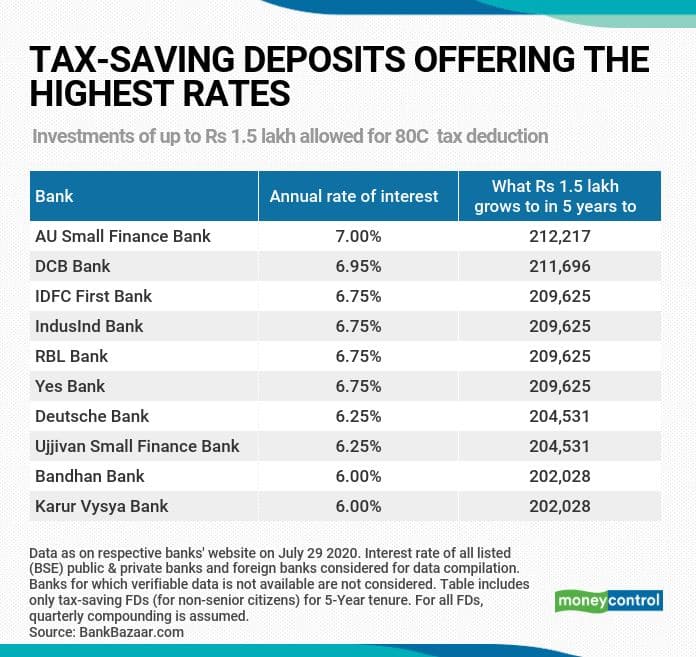

Certain conservative investors prefer tax-saving FDs for taking the section 80C deduction benefit. Investments up to Rs 1.5 lakh can be claimed for deduction under section 80C of the income tax act. Tax saving FDs have a lock-in period of five years and premature withdrawals are not allowed.

In these uncertain COVID-19 times, investors are moving away from riskier assets to safer options such as FDs to preserve their capital, despite the steady decline in interest rates over the last one year.

Select private and small finance banks offer better rates

As many as 10 private banks offer tax-saving FDs with rates of 6 per cent or more. AU Small Finance Bank tops the chart with 7 per cent interest, followed by private banks such as DCB Bank, IDFC First Bank, IndusInd Bank, Yes Bank and RBL Bank, according to data compiled by BankBazaar.

After allocating to small-savings and other tax saving avenues, investors can park any surplus available in such FDs.

Axis Bank, ICICI Bank offer 5.5 per cent and HDFC Bank offer 5.35 per cent on five-year fixed deposits. State Bank of India (SBI) and Bank of Baroda (BOB) pay 5.40 per cent and 5.30 per cent, respectively.

A sum of Rs 1.5 lakh invested in AU Small Finance Bank’s tax-saving FD grows to Rs 2.12 lakh after five years.

|